Stamp Duty and Registration at the Time of Property Purchase

Written by Prerita Aggarwal & Souvik Chatterjee

Buying a house is an experience for a lifetime binding with emotions. Thus it is very important to have financial and legal literacy and discipline to make any decision with respect to buying a property. It is essential to have legal evidence of the possession of the property, mere physical possession of the property does not make one an owner of the property. Transfer of ownership is not a simple process. A property buyer has to pay some charge in form of stamp duty and registration. Here, we will now discuss on how to process stamps duty and registration at the time of property purchase.

Stamp Duty

Stamp duty is a legal tax payable in full and acts as a proof for any sale or purchase of a property. The levy of stamp duty falls under state subject and thus the stamp duty rates vary from state to state. The stamp duty is levied by the centre on specified instruments and also fixes the rates for these instruments. Upon payment of the stamp duty, the documents become legally valid and then can be produced before the Court of Law.

Stamp duty needs to be paid on all types of instruments including an agreement to sell, conveyance deed, gift deed except on will. It is very important to know that stamp duty can be paid by either of the following ways i.e. Stamp Paper, E- Stamp or Franking.

While buying a house, we need to identify the property, make down payment, apply for home loan, sign the sale agreement, etc. One of the important step & the final step while buying a house is the possession and registration of your property. After the possession of the property is being transferred to you, it is your responsibility to get it registered in your name.

Registration

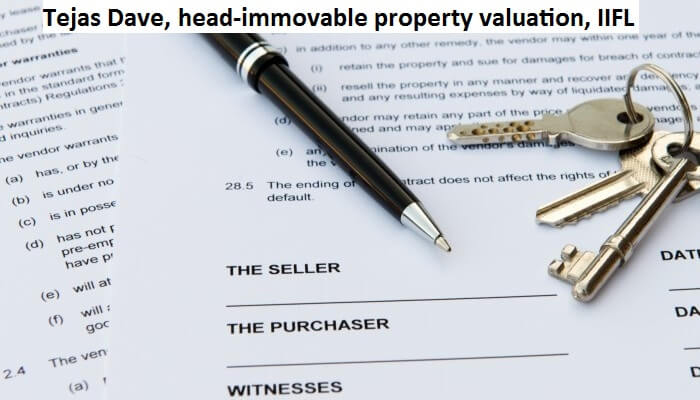

As soon as the stamp duty is paid, the document must be registered according to the Indian Registration Act, 1908, with the Sub-Registrar of the concerned Locality. The primary object of the act is to ensure that the information on all the deals is correct and Legitimate Property/ Land records are maintained. The purpose of registration is to get the transaction validated and for transfer of ownership.

The registration process involves making a stamp duty and paying the registration fee for the Title Document and has the said title document legally recorded with the Sub-registrar. It is very important to verify the title of the property, the value of the Property.

As stated earlier, it is crucial to register the property and pay its stamp duty as it gives the Legal ownership of the property and helps in elimination of any ownership dispute.

Tags

Disclaimer: The information contained in this post is for general information purposes only. IIFL Home Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment, etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness, or of the results, etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability, and fitness for a particular purpose. Given the changing nature of laws, rules, and regulations, there may be delays, omissions, or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan product specifications and information that may be stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan.

Login

Login