Understanding the MHADA Housing Lottery: All you need to know

The Maharashtra Housing and Development Authority (MHADA) is a government body responsible for providing affordable housing in Maharashtra. One of its key initiatives is the housing lottery, which offers a chance for eligible applicants to secure a home at subsidised rates. In this article, you will learn about all the relevant details of the MHADA housing lottery.

The MHADA Housing Lottery Process

The MHADA Housing Lottery isn’t open to everyone, making it essential to understand the MHADA lottery eligibility criteria before applying. The lottery categories applicants based on their income levels, ensuring that housing opportunities are available to those who need them the most.

Income-Based Categories:

- Economically Weaker Section (EWS): This category is for individuals with an annual income of up to ₹3 lakhs. The EWS category offers the most affordable housing options.

- Low Income Group (LIG): Applicants with an income between ₹3 lakhs and ₹6 lakhs fall into this category. The LIG flats are slightly more expensive than those for EWS but are still within reach for many.

- Middle Income Group (MIG): With an income bracket of ₹6 lakhs to ₹12 lakhs, the MIG category offers more spacious and well-equipped housing units.

- High Income Group (HIG): This category is for individuals earning above ₹12 lakhs annually. HIG units are premium properties, often located in prime areas.

Age, Residency, and Other Essential MHADA Eligibility Requirements

- Applicants must be at least 18 years old.

- They must be residents of Maharashtra for a minimum of 15 years.

- Applicants or their family members should not own any residential property in Maharashtra.

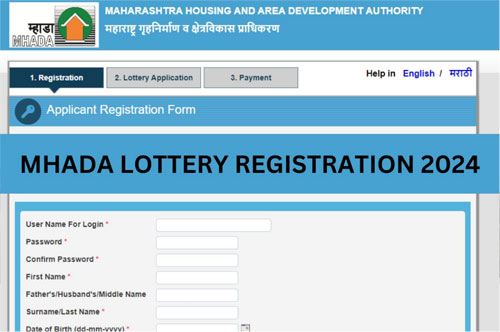

Application Procedure for MHADA Housing Lottery

The application process for the MHADA housing lottery is easy, but it requires attention to detail to ensure that everything is in order.

- Step-by-Step Guide to Submitting an MHADA Online Application

- Visit the official MHADA website and create an account.

- Fill in the required details, including personal information, income details, and preferred housing category.

- Upload the necessary documents required for the MHADA lottery form such as proof of income, identity proof, and residency proof.

- Review your MHADA lottery application carefully before submission to avoid any errors.

- Key Dates and Deadlines to Remember

MHADA announces specific dates for the lottery each year, including the application start date, deadline, and draw date. Keep track of these dates to ensure you don’t miss out.

- Application Fees and Payment Process

The application fee varies based on the housing category. Payment can be made through the MHADA lottery online portal, and it’s important to complete this step promptly as your application won’t be processed without it.

The Lottery Draw

The lottery draw is the most anticipated part of the process. It’s conducted with utmost transparency to ensure fairness.

- How the Lottery Draw is Conducted?

MHADA uses a computerised random selection process, which eliminates any possibility of bias or manipulation. The entire process is often broadcast live for public viewing, adding an extra layer of transparency.

- Announcement of Winners

Winners are announced on the official MHADA website and also notified via e-mail. If you’re selected, you’ll receive further instructions on how to proceed with the verification and payment process.

Types of Housing Units Available

MHADA offers a range of housing units tailored to different income groups, ensuring that everyone has an opportunity to own a home.

- EWS Units: Affordable units with basic amenities.

- LIG Units: Slightly larger and more equipped than EWS units.

- MIG Units: Larger units with better amenities and facilities.

- HIG Units: Premium units with high-end amenities and finishes.

Locations of MHADA Projects

MHADA projects are spread across various cities and towns in Maharashtra, including Mumbai, Thane, Pune, and Nagpur. The location can significantly impact the property value and amenities.

Post-Lottery Process

Once you’re selected in the lottery, the real work begins.

Verification and Documentation

You must keep the documents required for MHADA lottery handy.

- Document Submission: Submit the required documents for verification, such as income proof, address proof, and identity proof.

- Verification Process: MHADA will verify your MHADA eligibility and the authenticity of your documents.

Payment and Financing Options

- Payment Schedules: Adhere to the payment schedule outlined by MHADA, including down payments and instalments.

- Home Loan Options: Explore home loan options from banks and financial institutions to finance your purchase.

Possession and Ownership

- Timeline for Possession: Receive your allotted flat within the specified timeframe.

- Rights and Responsibilities: Understand your rights and responsibilities as a homeowner.

- Financial Planning: Check the housing loan interest rates to plan your finances better.

Wrapping Up

Owning a home through the upcoming MHADA lottery can be a life-changing experience. With its transparent process, diverse housing options, and dedicated support, MHADA has made homeownership a reality for many in Maharashtra. If you’re planning to apply, make sure you’re well-prepared and informed. If you're considering this route, prepare thoroughly and explore financing options, like using a home loan EMI calculator to manage costs effectively.

If you need financial assistance, consider exploring the home loan options available through IIFL Home Loans, designed to make your dream of owning a home attainable.

FAQs

Q1. Can I apply for multiple MHADA housing schemes simultaneously?

You can apply for multiple schemes if you meet the MHADA eligibility criteria for each.

Q2. What happens if I am not selected in the lottery?

If you are not selected, you can reapply in future lotteries.

Q3. Can I sell my MHADA-allotted flat immediately?

There might be restrictions on resale, especially for subsidised units. Check the specific terms and conditions.

Q4. Can I avail of a home loan for an MHADA flat?

You can get a home loan from banks or financial institutions to finance your purchase.

Q5. How long does it typically take to get possession of an MHADA flat?

The possession timeline can vary depending on the project and construction progress.

Tags

Disclaimer: The information contained in this post is for general information purposes only. IIFL Home Finance Limited (including its associates and affiliates) ("the Company") assumes no liability or responsibility for any errors or omissions in the contents of this post and under no circumstances shall the Company be liable for any damage, loss, injury or disappointment, etc. suffered by any reader. All information in this post is provided "as is", with no guarantee of completeness, accuracy, timeliness, or of the results, etc. obtained from the use of this information, and without warranty of any kind, express or implied, including, but not limited to warranties of performance, merchantability, and fitness for a particular purpose. Given the changing nature of laws, rules, and regulations, there may be delays, omissions, or inaccuracies in the information contained in this post. The information on this post is provided with the understanding that the Company is not herein engaged in rendering legal, accounting, tax, or other professional advice and services. As such, it should not be used as a substitute for consultation with professional accounting, tax, legal or other competent advisers. This post may contain views and opinions which are those of the authors and do not necessarily reflect the official policy or position of any other agency or organization. This post may also contain links to external websites that are not provided or maintained by or in any way affiliated with the Company and the Company does not guarantee the accuracy, relevance, timeliness, or completeness of any information on these external websites. Any/ all (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan product specifications and information that may be stated in this post are subject to change from time to time, readers are advised to reach out to the Company for current specifications of the said (Home/ Loan Against Property/ Secured Business Loan/ Balance Transfer/ Home Improvement Loan/ NRI Home Loan/ Home Loan for Uniformed Services) loan.

Login

Login