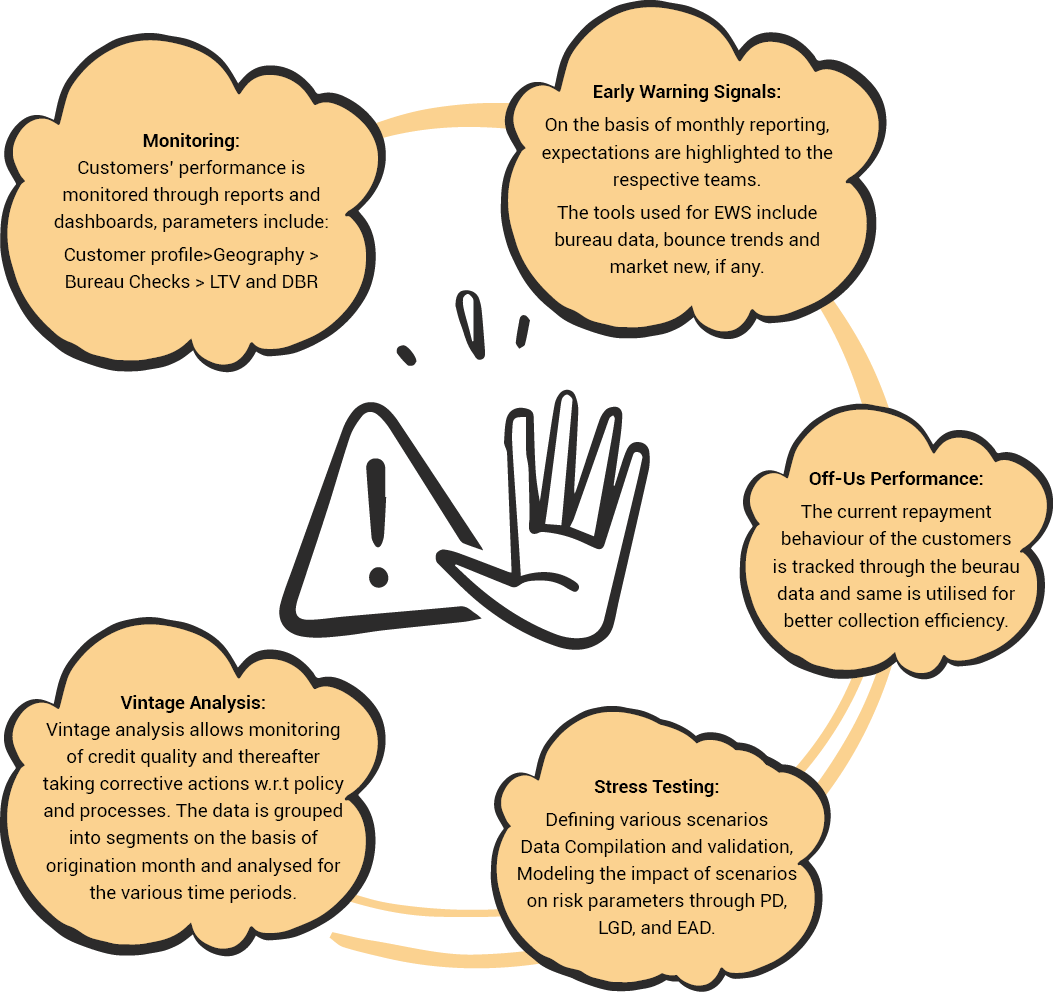

Risk management is integral to the Company’s strategy. The comprehensive understanding of risk management

throughout the various levels of an organisation aids in driving key decisions related to risk-return balance, capital

allocation and product pricing. The Company has a well-defined Risk Management Strategy and a Framework which

is designed to identify, measure, monitor and mitigate various risks. Additionally, it is also ensured that appropriate

focus is on managing risk proactively by ensuring business operations are in accordance with laid-down risk. A Board

approved Risk Management Policy has been put in place to establish appropriate systems or procedures to mitigate all

material risks faced by the Company

The Company is exposed to different types of risks emanating from both internal and external sources. A strong risk

management team and an effective credit operations structure ensures that risks are properly identified and timely

addressed, to ensure minimal impact on the Company’s growth and performance.

Risk Management team, identifies, analyses, and takes measures to mitigate risks faced by the Company. The team is

guided by the Company’s Risk Management Committee and the Senior Management to develop and implement Risk

Assurance practices on a pan-organisational basis.