-

Corporate Overview

- About this Report

- Solid. Smart. Sustainable.

- On a Solid Footing

- Smart Solutions

- Sustainable Housing - The Big Shift

- Letter form the Chairman

- Strategic Overview from the CEO's Perspective

- Customer Testimonials that Speak of Our solid Foundation

- Financial Performance that is Solid, Smart and Sustainable

- Digital Technology Enhancing Productivity

- India's Smart Future of Financing Co-lending

- Applying Data Analytics

- IIFL Home Finance - Aligned to Government Initiatives

- Environment, Social, Governance (ESG)

- Environmental Responsibility

- Supporting Local Communities

- Education and Development

- Creating Livelihood and Financial Inclusion

- Fostering Human Capital

- Corporate Governance

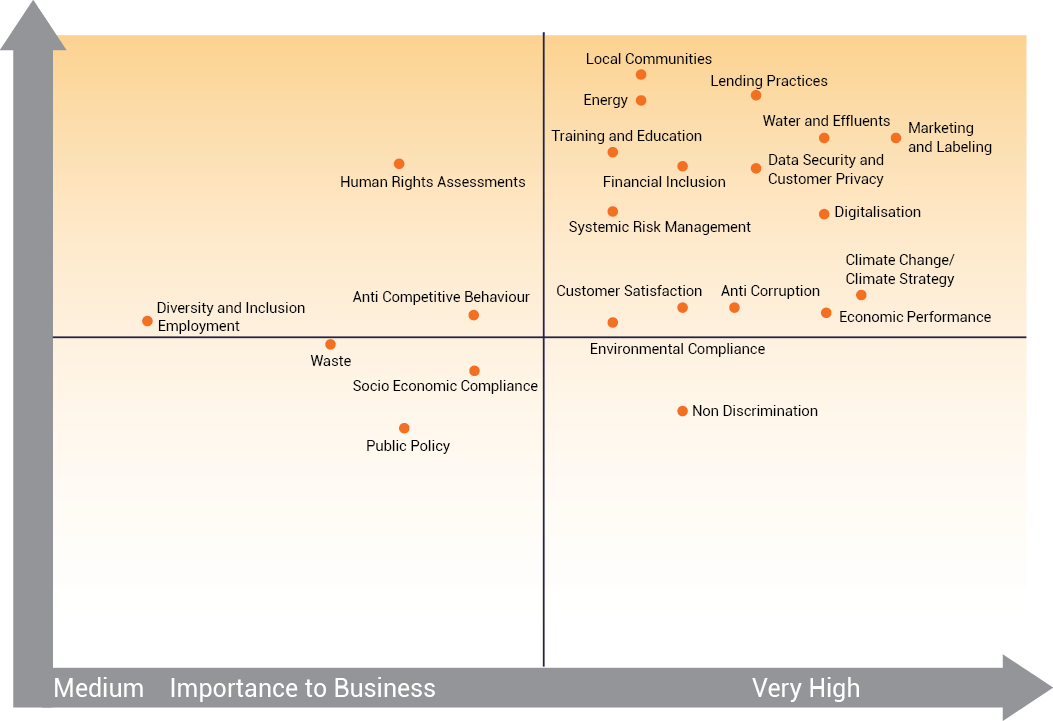

- Meteriality Assessment and Key Topics Raised

- Risk manangement Framework

-

Statutory Reports

-

Financial Statements