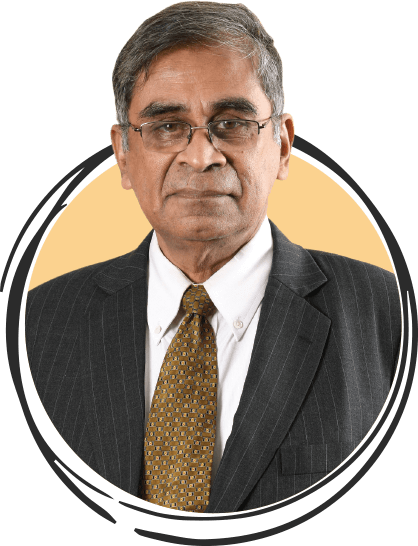

Mr. S. Sridhar (Chairman and Independent Director)

Srinivasan Sridhar is the Chairman and an Independent Director on our Board of Directors. He holds a Bachelor’s degree in science from Bangalore

University and a master’s degree of science in physics from the Indian Institute of Technology, Delhi. He has previously worked in the banking and

finance industry and has held several positions in retail, corporate, and export / import banking, including as the chairman of the National Housing

Bank and Central Bank of India. While he was chairman and managing director of the National Housing Bank, he was responsible for a number of

initiatives, such as the NHB Residex, Rural Housing Fund, and Reverse Mortgage for senior citizens. Prior to this, he was associated with the Export

Import Bank of India as executive director. He is a certified associate of the Indian Institute of Bankers and was conferred with honorary

fellowship of the Indian Institute of Banking and Finance in recognition of his contribution in the field of banking and finance.