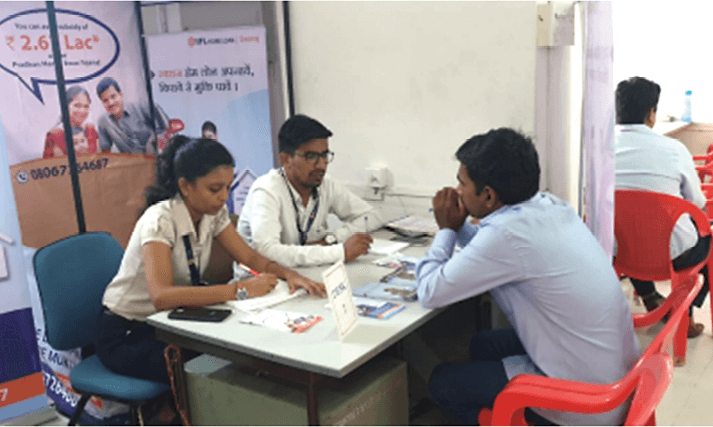

Our digital strategy is aligned with the organisation’s cultureof customer-centricity and ‘Complete Profitability’ with an equal focus on People, Organisation, Society and Environment. With strong digital capabilities and efficient processes across business functions, we ensure superior customer experience, enhanced transparency and sustained growth.

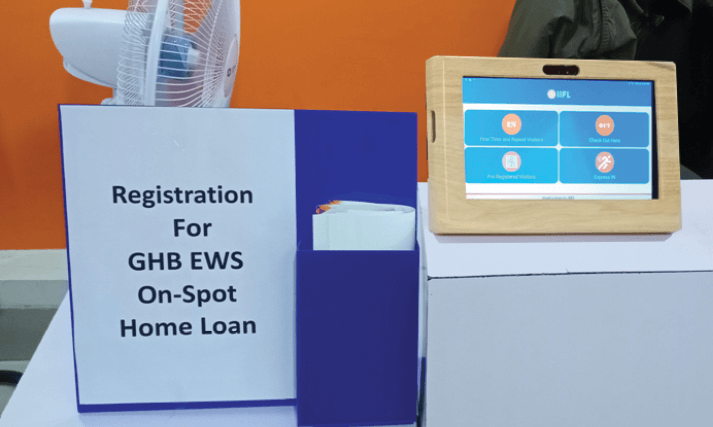

We have in place a complete paperless credit underwriting mechanism that includes analysis of KYCs, income documents, credit history, business set-up and profile of the customer. The decision making process is fully automated with the help of business rule engine. In addition, latest digital platforms ensure adequate quality checks.